monterey county property tax rate 2021

The present value of. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate.

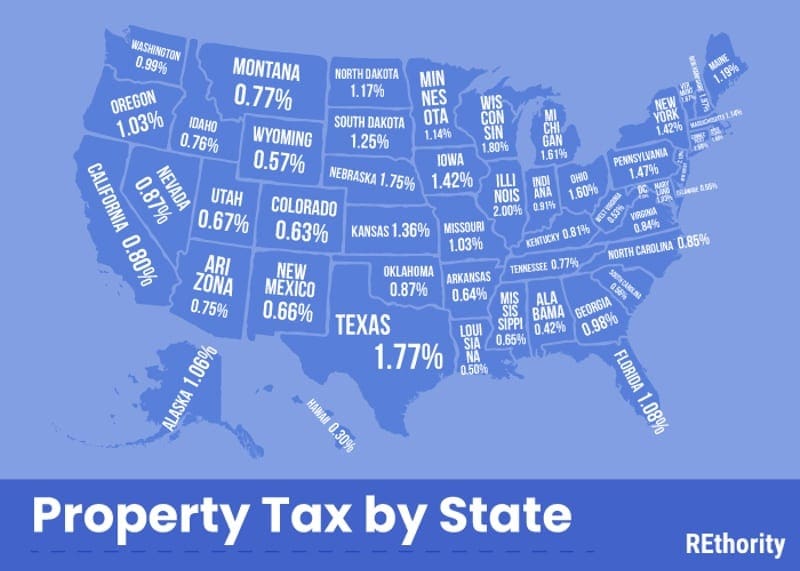

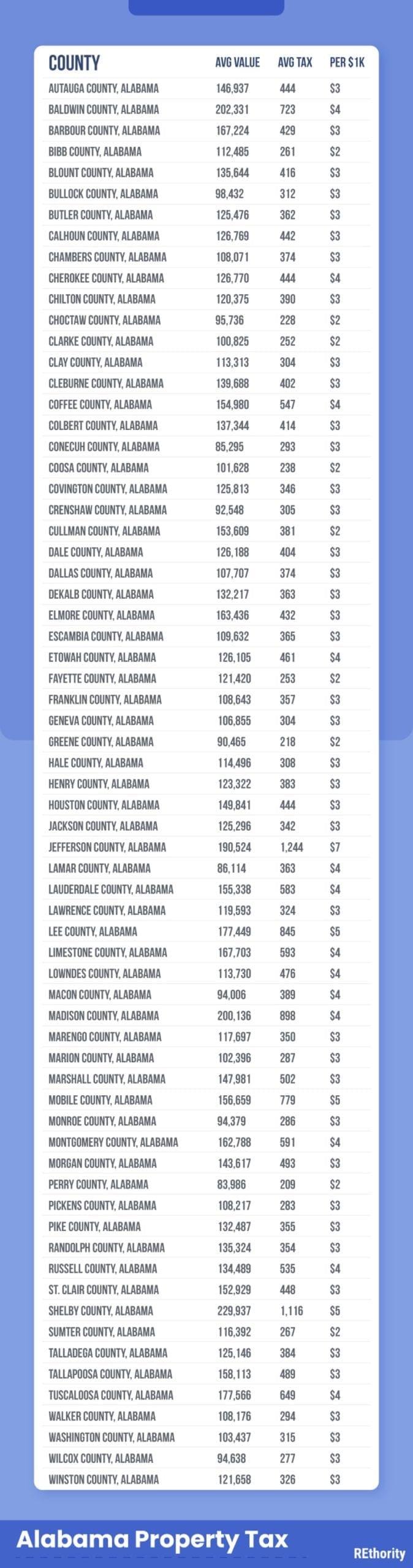

Property Tax By County Property Tax Calculator Rethority

The second payment is due september 1 2021.

. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021. Ad Property Taxes Info. As a result if your home is valued at 1000000 and.

202021 Monterey County Tax Rates - 10 - Debt Service Tax Rates SCHOOL DISTRICTS CONTINUED TAX RATE Shandon Unified School District 2016 San Luis Obispo 0060000. Ad Uncover Available Property Tax Data By Searching Any Address. The second payment is due september 1 2021.

Website Design by Granicus - Connecting People and. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax. Thus its primarily all about budgeting first.

We Provide Homeowner Data Including Property Tax Liens Deeds More. Note that 1095 is an effective tax rate. The Treasurer-Tax Collectors office does not charge a fee to process payments on-line however the vendor processing your payments assesses the following service fees.

Monterey County Property Tax Due Dates 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Method to calculate Monterey County sales tax in 2021.

Monterey County Property Tax Due Dates 2021. For all due dates if the date falls on a saturday sunday or county holiday the due date is extended to the following business day. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate.

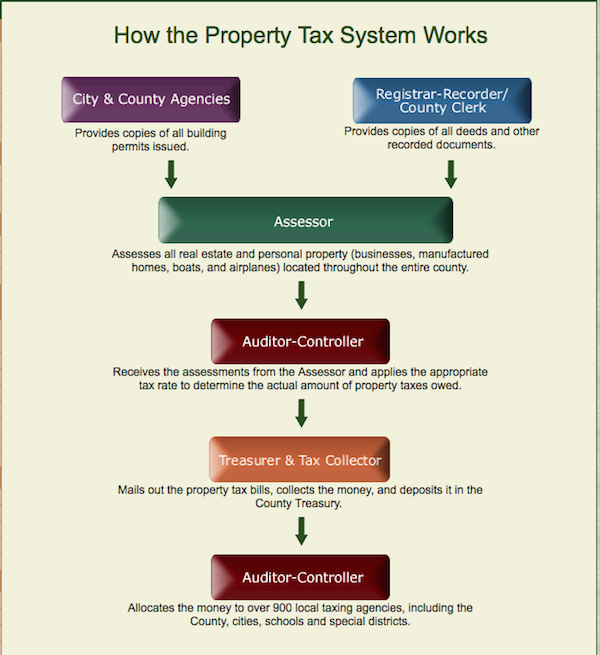

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services. The transfer tax is levied on a portion of the assessed value of a property that exceeds the countys property tax rate. Monterey county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property.

The tax collector processes all real estate personal property tax bills payments. 202122 Monterey County Tax Rates - 10 - Debt Service Tax Rates SCHOOL DISTRICTS CONTINUED TAX RATE Santa Rita Union School District 2006 Series B 2017 2019 Refunding. For all due dates if the date falls on a saturday sunday or county holiday the due date is extended to the following business day.

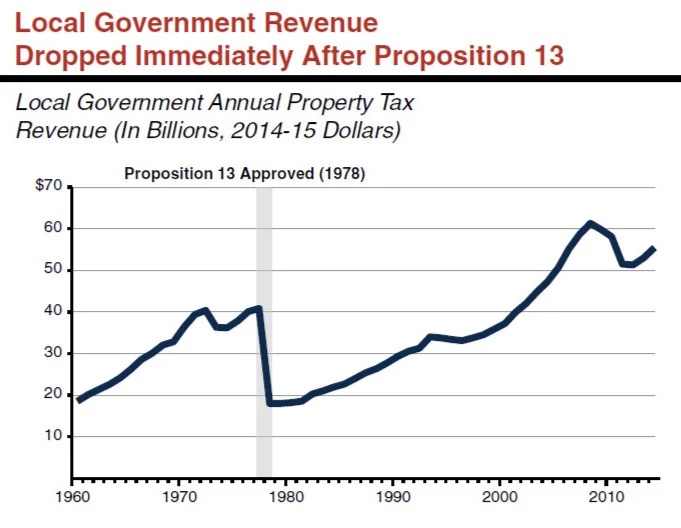

The present value of. New Ashford 413 458-5461. Proposition 13 enacted in 1978.

To Contact the Property Tax Section Please email Audptaxcomontereycaus or call 831 755-5040 2022 Monterey County CA. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. As computed a composite tax rate times the market worth total will provide the countys whole tax burden and include individual taxpayers share.

The tax collector processes all real estate personal property tax bills payments. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Monterey 413 528-6481.

Property Tax By County Property Tax Calculator Rethority

Property Tax California H R Block

Los Angeles Property Tax Which Cities Pay The Least And The Most

Monterey County Property Tax Guide Assessor Collector Records Search More

Property Tax By County Property Tax Calculator Rethority

Arlington City Council Approves 2021 Budget Lowers Property Tax Rate For Fifth Straight Year

California Property Tax Calculator Smartasset

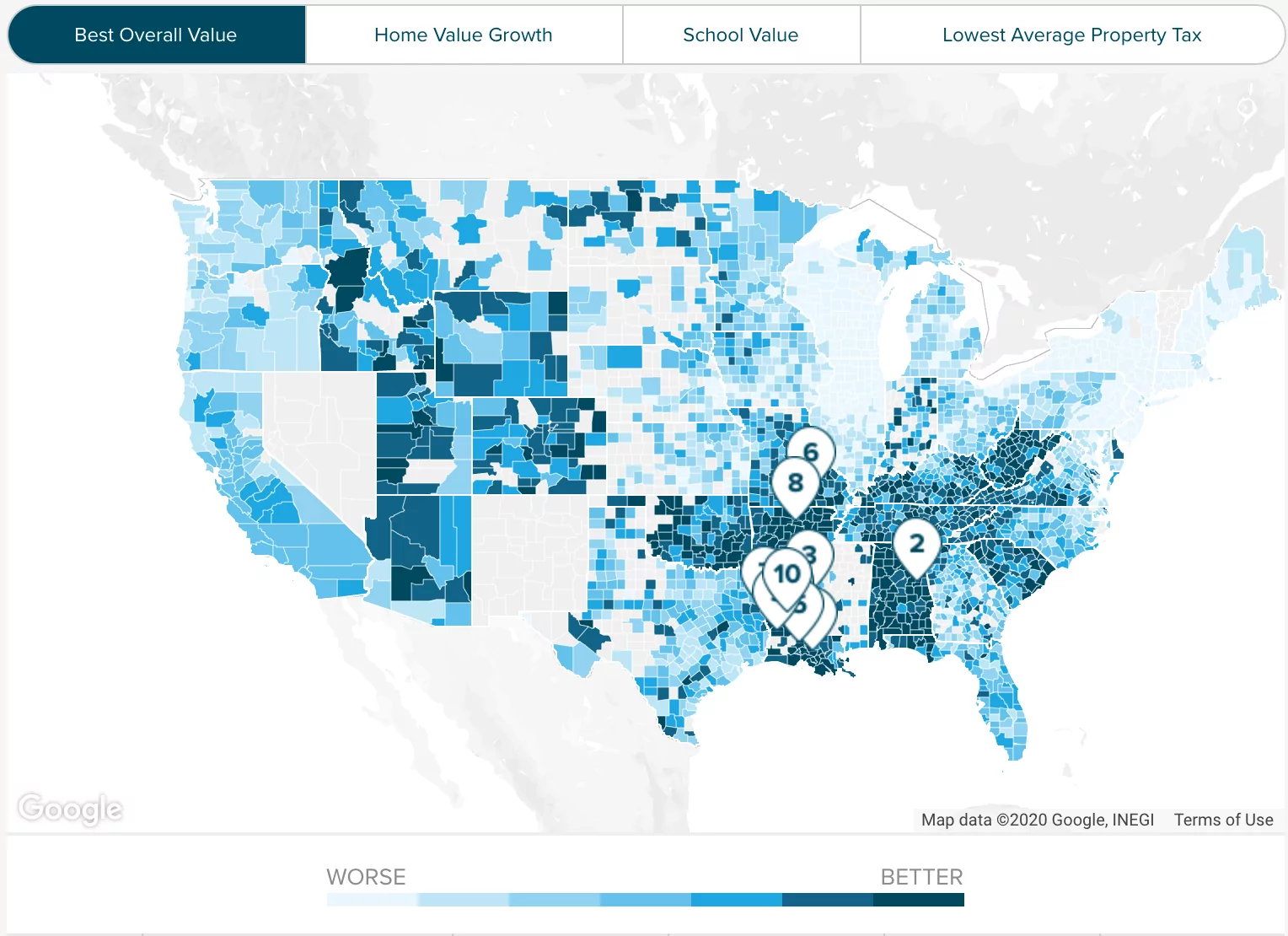

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Cape County Sets Property Tax Rates The Cash Book Journal

Additional Property Tax Info Monterey County Ca

Orange County Ca Property Tax Calculator Smartasset

Monterey County Schools Coping With Declining Enrollment Monterey Herald

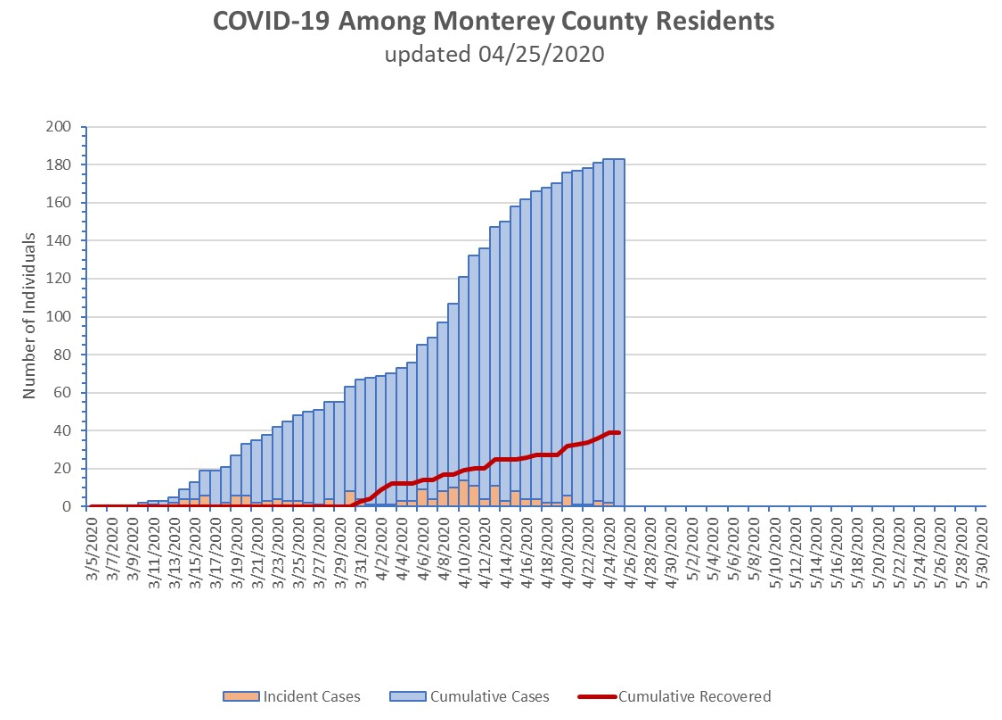

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Monterey County Property Tax Guide Assessor Collector Records Search More

Orange County Ca Property Tax Search And Records Propertyshark

Prop 218 Benefit Assessment North County Fire Protection District

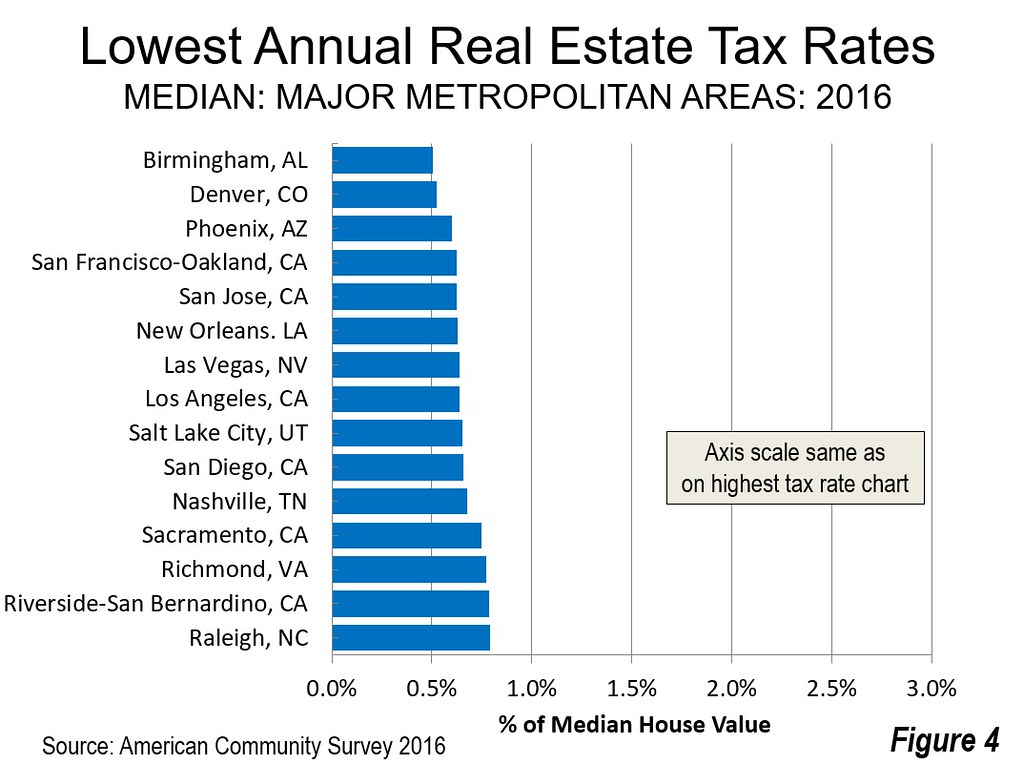

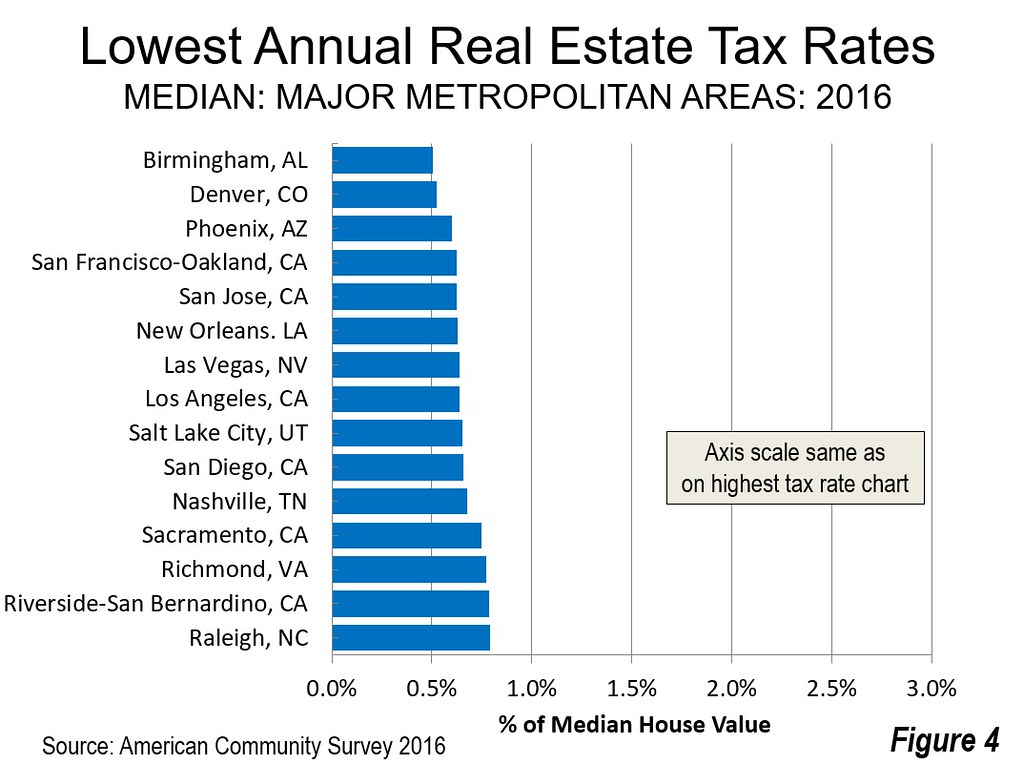

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com